Starting or growing a business is exciting.

But let’s be honest…

👉 Cash flow is the #1 problem for most entrepreneurs.

Inventory.

Marketing.

Equipment.

Employees.

Rent.

Everything costs money — and often more than you expect.

That’s why millions of small businesses use business loans every year.

And in 2026, lenders are offering:

✅ Faster approvals

✅ Lower interest rates

✅ Online applications

✅ Funding in 24–48 hours

In this complete guide, you’ll discover:

✔ The best small business lenders in 2026

✔ SBA vs online loans explained

✔ How to qualify fast

✔ Interest rates comparison

✔ How much you can borrow

✔ Expert tips to avoid costly mistakes

Sommaire

ToggleWhat Is a Small Business Loan?

Why Business Loans Are So Popular in 2026

Types of Business Loans (Important)

1️⃣ Term Loans

Fixed amount + fixed payment

Best for equipment or expansion

2️⃣ SBA Loans

Government-backed

Lowest interest

Long repayment terms

3️⃣ Lines of Credit

Flexible

Borrow only what you need

4️⃣ Equipment Financing

Buy machines/vehicles/tools

Buy machines/vehicles/tools

Fast but expensive (use carefully)

🔥 Best Small Business Loans in 2026 (Top Picks)

🔥 Lendio – Best Marketplace (Compare Many Lenders)

✔ Compare 75+ lenders

✔ Loans up to $2M

✔ Fast prequalification

✔ Great for startups

👉 Check eligibility

👉 Get a free quote

👉 Apply now

Perfect if you want the best rate automatically.

🔥 BlueVine – Best Line of Credit

✔ Up to $250,000

✔ Same day funding

✔ Only pay what you use

👉 Check eligibility

👉 Get a free quote

👉 Apply now

Excellent for cash flow gaps.

🔥 OnDeck – Fastest Approval

✔ Funding in 24 hours

✔ Simple process

✔ Great for small shops

👉 Check eligibility

👉 Get a free quote

👉 Apply now

Best for urgent needs.

🔥 Fundera – Best SBA Loans

✔ Low interest rates

✔ Long terms

✔ Government backed

👉 Check eligibility

👉 Get a free quote

👉 Apply now

Cheapest long-term option.

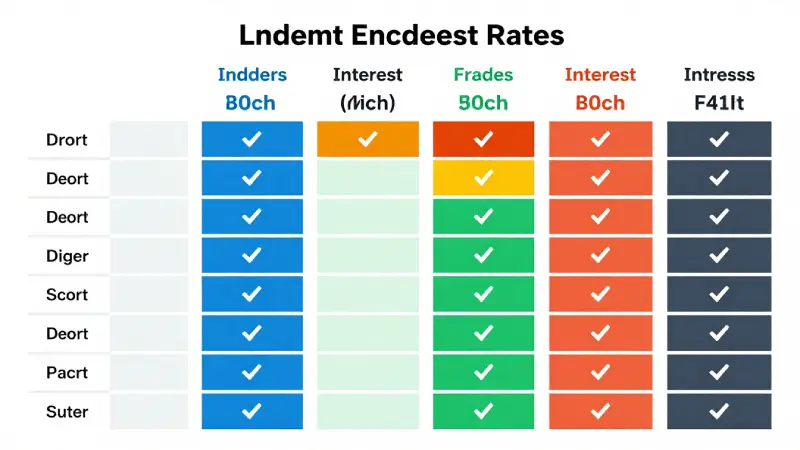

Business Loan Rates Comparison Table

| Lender | Loan Amount | APR | Funding Speed | Best For |

|---|---|---|---|---|

| Lendio | $5k–$2M | 6–30% | 24–72h | compare offers |

| BlueVine | $250k | 7–25% | same day | credit lines |

| OnDeck | $250k | 9–35% | 24h | fast cash |

| Fundera | $5M | 5–15% | 1–2 weeks | SBA |

How Much Can You Borrow?

Who Qualifies Easily?

You have higher chances if:

✅ 6+ months in business

✅ $8k+ monthly revenue

✅ 600+ credit score

✅ business bank account

Step-by-Step: How to Apply

Step 1

Check revenue and credit

Step 2

Prequalify online (soft check)

Step 3

Compare APRs

Step 4

Upload documents

Step 5

Receive funds

Done in 1–3 days.

Mistakes to Avoid

❌ Borrowing too much

❌ Ignoring APR

❌ Taking merchant cash advances blindly

❌ Missing payments

❌ Mixing personal & business money

Need Personal Financing

If you also need personal financing, read:

👉 Credit cards guide

https://nexuora.com/best-0-apr-credit-cards-2026/

👉 Insurance protection

https://nexuora.com/best-business-insurance-companies-2026/

👉 Make money online ideas

https://nexuora.com/category/make-money-online/

👉 AI tools for entrepreneurs

https://nexuora.com/best-ai-tools-2025/

According

According to:

Forbes business finance

https://www.forbes.com/advisor/business-loans/

NerdWallet business loans

https://www.nerdwallet.com/best/small-business/small-business-loans

SBA official site

https://www.sba.gov/funding-programs/loans

These sources confirm business loans remain the fastest growth sector for entrepreneurs.

Real Example: ROI of a Loan

Borrow $20,000 for marketing.

Generate $80,000 sales.

Repay $22,000.

Profit = $58,000.

Loans are tools — use wisely.

FAQ

Usually 600+ (SBA 650+)

Yes, online lenders or SBA microloans

24h–72h

Often yes (consult accountant)

Yes for low rates, but slower approval

Final Thoughts

The right loan can:

✔ grow your business

✔ increase revenue

✔ hire staff

✔ buy equipment

✔ scale faster

But always compare lenders first.

👉 Start with marketplaces like Lendio to get the lowest rate.

Smart financing = faster success.

Ahmada Ndao est entrepreneur digital et consultant en intelligence artificielle, fondateur de SenAI2S.

À travers Nexuora, il partage des analyses, guides pratiques et stratégies sur l’IA, le business en ligne et les technologies émergentes, avec un focus sur l’impact réel et les opportunités globales.