In 2025, traditional banking is being replaced by faster, smarter, and more rewarding online banks. With high-interest savings accounts (HISAs), customers can earn up to 10x more interest compared to brick-and-mortar banks.

If you’re tired of low savings returns, switching to the right online bank could be your smartest financial move this year. In this guide, we’ll review the 7 best online banks with high-interest savings accounts in 2025, their APY rates, fees, and unique features.

👉 Whether you’re in the U.S., Europe, or Africa, this list will help you pick the right digital bank to grow your money.

Sommaire

Toggle1. Ally Bank – The Customer Favorite

2. Marcus by Goldman Sachs – Best for High-Yield Growth

APY (2025): 4.50%

Minimum Balance: $0

Monthly Fees: None

Best For: People seeking stability and slightly higher rates.

Why Marcus is great:

Backed by Goldman Sachs, Marcus combines the trust of a global financial powerhouse with competitive high-yield savings. It also offers personal loans and investment products for wealth growth.

Compare with Betterment and Wealthfront for those interested in combined savings + investing.

3. Discover Online Savings – Best All-in-One

APY (2025): 4.35%

Minimum Balance: $0

Monthly Fees: None

Best For: Savers who also want a strong credit card ecosystem.

Why choose Discover:

Discover gives you seamless access to savings, credit cards, and even student loans, all in one ecosystem. It’s perfect if you want to manage your money in one place.

4. Chime – Best for Mobile-First Users

APY (2025): 2.00% (lower than others, but with extra perks)

Minimum Balance: $0

Monthly Fees: None

Best For: Millennials and Gen Z who want quick access and no banking headaches.

Why Chime is unique:

While its APY is lower, Chime makes up for it with early paycheck access, fee-free overdrafts, and debit card perks. It’s more of a hybrid “finance lifestyle app” than a pure savings account.

5. SoFi Money – Best Hybrid Banking & Investing

APY (2025): 4.60%

Minimum Balance: $0

Monthly Fees: None

Best For: Users who want to combine banking with investing and crypto.

Why SoFi stands out:

With SoFi, you can earn high-interest savings, trade stocks and crypto, and even refinance student loans—all within one app. Perfect for tech-savvy investors.

6. Varo Bank – Best for Everyday Saving + Bonuses

APY (2025): Up to 5.00% (with conditions)

Minimum Balance: $0

Monthly Fees: None

Best For: High-yield seekers who can meet account conditions.

Why Varo is powerful:

Varo offers tiered APY—standard savings at 3.00%, but up to 5.00% if you set up direct deposits and keep your balance under $5,000.

💡 Pro Tip: Use Varo as your “goal-based” savings account while keeping a main checking account elsewhere.

7. Capital One 360 – Best Traditional/Online Hybrid

APY (2025): 4.20%

Minimum Balance: $0

Monthly Fees: None

Best For: People who want both online convenience and physical branch access.

Why Capital One still wins:

Unlike other online banks, Capital One gives you the flexibility to visit branches when needed, while still enjoying competitive high-yield savings.

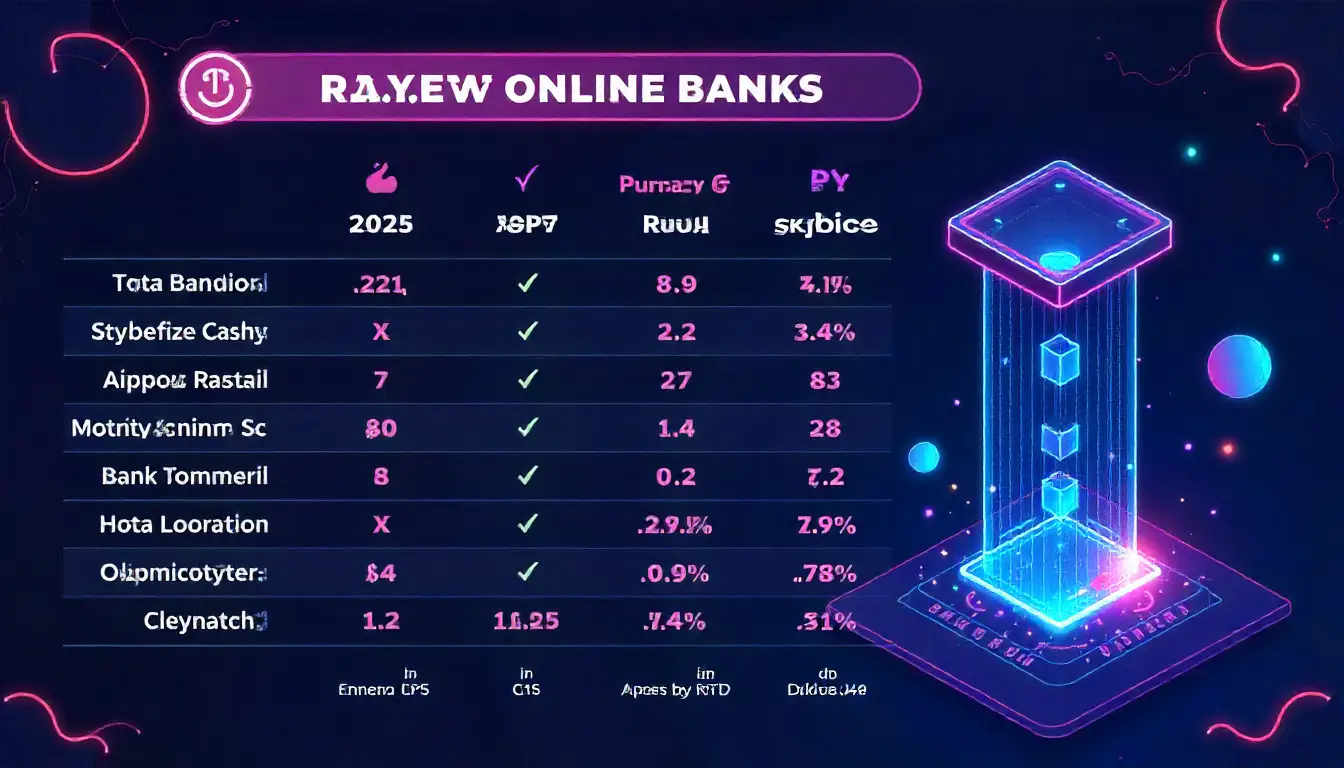

📊 Quick Comparison Table

| Bank | APY (2025) | Minimum Balance | Monthly Fees | Best For |

|---|---|---|---|---|

| Ally Bank | 4.25% | $0 | None | Everyday savers |

| Marcus by GS | 4.50% | $0 | None | Stability + growth |

| Discover Savings | 4.35% | $0 | None | All-in-one banking |

| Chime | 2.00% | $0 | None | Mobile-first users |

| SoFi Money | 4.60% | $0 | None | Banking + investing |

| Varo Bank | 5.00%* | $0 | None | High-yield seekers |

| Capital One 360 | 4.20% | $0 | None | Hybrid flexibility |

🔑 Key Takeaways

Online banks offer 4x to 10x higher APY compared to traditional banks.

Many accounts have $0 minimum balance and no monthly fees.

Each bank has unique perks: from investing integration (SoFi) to lifestyle banking (Chime).

Varo offers the highest APY (5.00%) but with conditions.

The best choice depends on your priorities: yield, flexibility, or ecosystem.

📌 Recommended Actions

Compare two banks (one for daily banking, one for high-yield savings).

Use finance apps (like Mint or Personal Capital) to track and optimize savings.

Pair your savings strategy with passive income streams → [Backlink to: “5 Passive Income Ideas That Actually Work”].

Always review APY updates—rates can change monthly.

Ahmada Ndao est entrepreneur digital et consultant en intelligence artificielle, fondateur de SenAI2S.

À travers Nexuora, il partage des analyses, guides pratiques et stratégies sur l’IA, le business en ligne et les technologies émergentes, avec un focus sur l’impact réel et les opportunités globales.