Saving money has always been a challenge, especially with rising costs in 2025. But thanks to modern technology, you don’t need a financial advisor to take control of your budget. Free finance apps now make it possible to track spending, automate savings, and even invest—all from your smartphone.

In this guide, we’ll show you exactly how to save $500 a month using the best free finance apps. Whether you’re a student, freelancer, or professional, these apps can help you cut expenses, grow savings, and achieve your financial goals.

Sommaire

Toggle🔹 Why Use Finance Apps?

Traditional budgeting methods—like spreadsheets—are outdated. Finance apps:

-

Sync automatically with your bank accounts.

-

Categorize your expenses (food, rent, subscriptions).

-

Provide real-time insights into where your money goes.

-

Send alerts when you overspend.

Best High-Paying Affiliate Programs in 2025

Most importantly, they’re free and can help you save $500/month by cutting unnecessary spending.

🔹 Step 1: Track Every Dollar

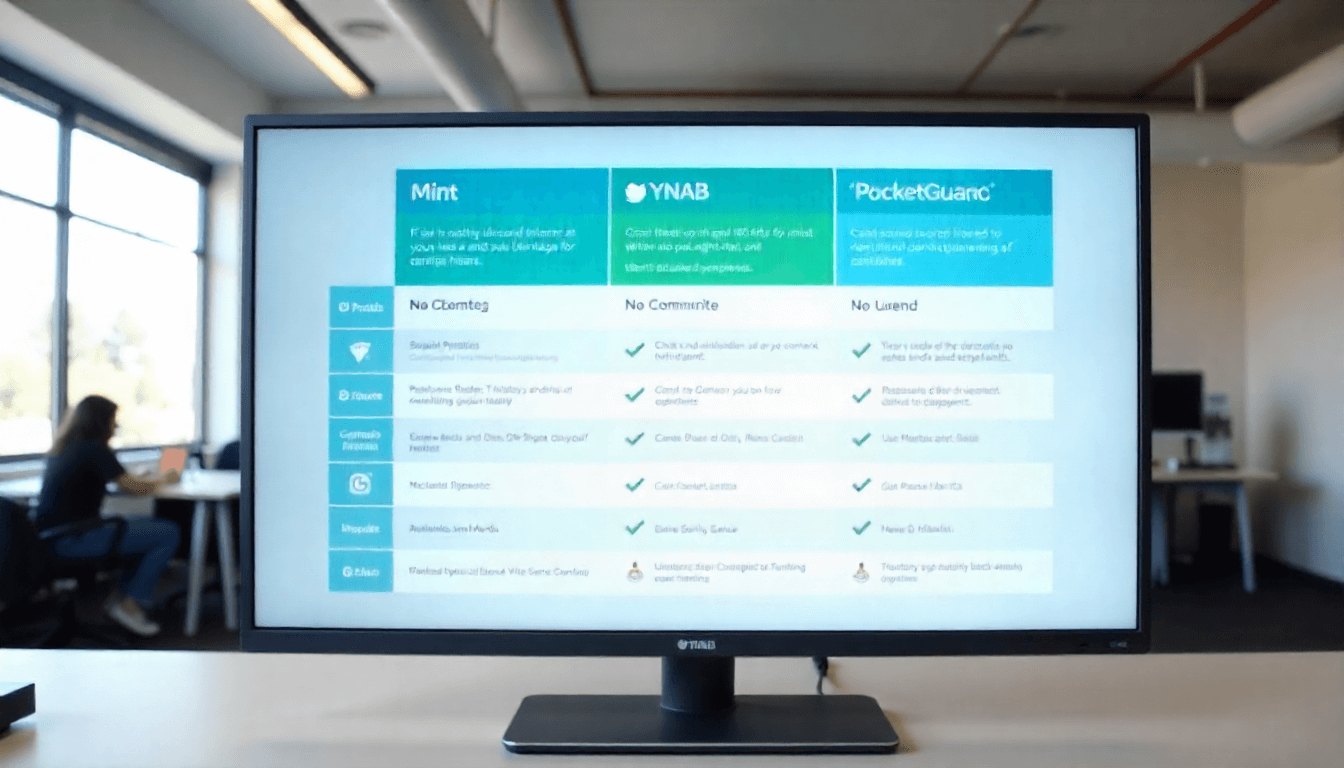

The first step to saving is understanding where your money goes. Apps like Mint and PocketGuard automatically pull your bank transactions and show you a clear picture.

💡 Tip: Look for recurring expenses—like forgotten subscriptions. Cancelling just two unused $20 subscriptions saves you $40/month ($480/year).

🔹 Step 2: Create a Realistic Budget

Once you know your spending habits, apps like YNAB (You Need A Budget) and Goodbudget let you create custom budgets.

Example:

-

Rent: $800

-

Food: $300

-

Transportation: $150

-

Subscriptions: $50

-

Savings: $500

By forcing yourself to allocate money in advance, you build a “conscious spending plan.”

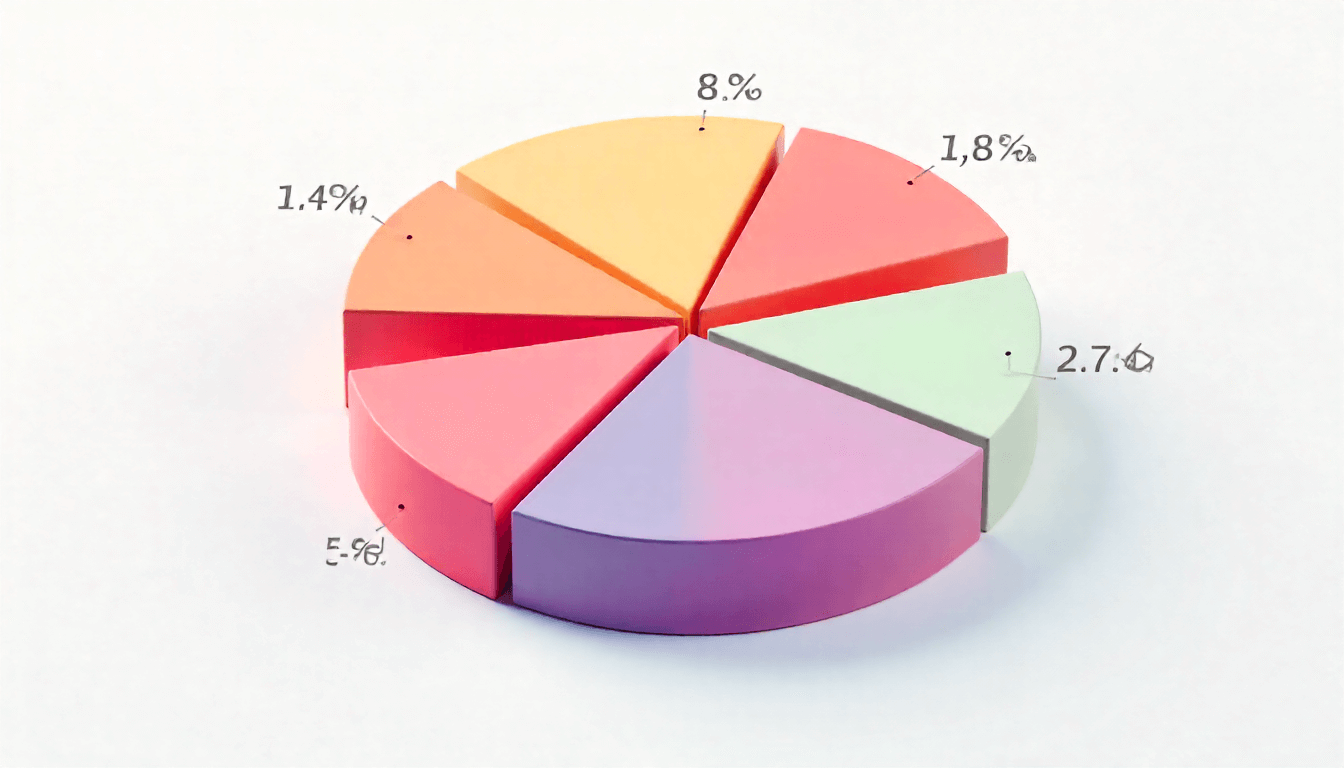

💡 With budgeting apps, most users report saving 15–20% more monthly. For someone earning $2,500/month, that’s about $375–$500 saved.

🔹 Step 3: Automate Your Savings

The easiest way to save is to make it automatic. Apps like Chime or Qapital round up your purchases and put the difference into a savings account.

Example: Spend $4.60 on coffee → app rounds up to $5 → $0.40 goes into savings. Do this daily, and you’ll save $30–50/month without noticing.

🔹 Step 4: Cut Unnecessary Costs

🔹 Step 5: Use Cashback & Rewards Apps

🔑 Real-Life Savings Example

Comparison Table of Best Free Finance Apps (2025)

Saving $500/month doesn’t require sacrifice—it requires smart tools. With the right mix of budgeting, automation, and cashback apps, anyone can build wealth faster in 2025.

Remember, the apps do the heavy lifting. Your role is simply to stay consistent and reinvest those savings.

👉 Recommended Reading:

Ahmada Ndao est entrepreneur digital et consultant en intelligence artificielle, fondateur de SenAI2S.

À travers Nexuora, il partage des analyses, guides pratiques et stratégies sur l’IA, le business en ligne et les technologies émergentes, avec un focus sur l’impact réel et les opportunités globales.