Choosing the best family health insurance plan in the USA for 2026 is more critical than ever. Healthcare costs continue to rise, making the wrong insurance choice potentially devastating to family finances. This guide reviews top providers, compares plans and costs by state, and offers strategies to select the most affordable, comprehensive coverage.

Families must consider premiums, deductibles, coverage networks, and subsidies. Whether using marketplace plans via Healthcare.gov or private providers, this article provides a complete roadmap to secure the right plan.

For broader financial planning and protection, also see our insurance resources:

Sommaire

ToggleWhy Family Health Insurance Matters in 2026

Healthcare inflation is outpacing general inflation, and emergencies can cost thousands. Adequate insurance provides:

-

Preventive care

-

Doctor visits & hospital stays

-

Pediatric coverage

-

Prescription medications

-

Mental health support

Families without coverage risk financial hardship. According to KFF, medical expenses remain a top cause of personal debt in the USA.

How to Compare Family Health Insurance Plans

Monthly Premiums

The monthly premium determines your fixed cost. Lower premiums often mean higher deductibles.

Deductibles & Out-of-Pocket Maximums

Deductibles indicate how much you pay before insurance starts covering costs. Out-of-pocket maximums cap your total annual expense.

Network Coverage

Check if your preferred doctors, hospitals, and specialists are included.

Subscriptions & Benefits

Some plans offer telehealth, wellness programs, and pediatric preventive coverage.

Marketplace options are available at Healthcare.gov.

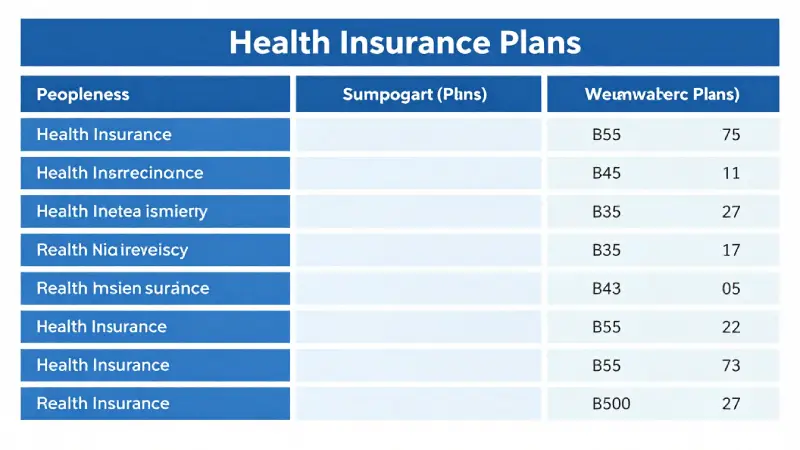

Top Family Health Insurance Providers in 2026

1. Blue Cross Blue Shield

Nationwide coverage, strong preventive care, flexible family packages.

2. UnitedHealthcare

Digital tools, telehealth, wellness incentives.

3. Kaiser Permanente

Integrated care system, predictable costs, preventive programs.

4. Aetna

Budget-friendly, pharmacy savings, large networks.

5. Cigna

International coverage, telehealth, family support programs

6. Humana

Focus on preventive care, multi-generational family plans.

7. Marketplace Plans

Income-based subsidies, essential coverage, standardized comparisons. See: Healthcare.gov marketplace.

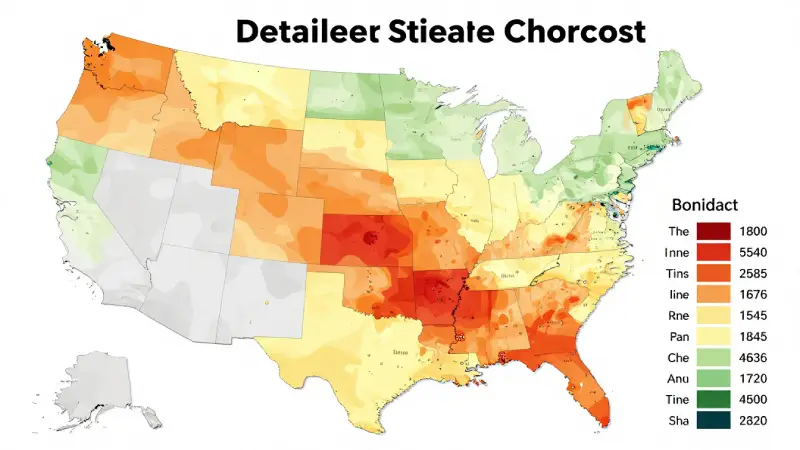

Family Health Insurance Costs by State (2026)

Cheapest Options for Families

-

Bronze marketplace plans

-

High-deductible plans with HSAs

-

Employer-sponsored coverage

-

Medicaid / CHIP for children

Subsidies via federal marketplace reduce costs for eligible families: Medicaid & CHIP.

Tips to Reduce Family Health Insurance Costs

-

Use preventive care services

-

Stick to in-network providers

-

Compare prescription coverage

-

Use telehealth for minor consultations

Common Mistakes

-

Focusing only on premiums

-

Ignoring network restrictions

-

Overlooking prescription coverage

-

Not reassessing annually

Future Trends in Family Health Insurance

-

Expanded telemedicine

-

Value-based care

-

AI-assisted diagnostics

-

Personalized insurance pricing

-

Preventive health incentives

FAQs (schema SEO)

A: Depends on your location, income, and needs. Marketplace silver plans often offer the best balance.

A: Subsidies, employer plans, high-deductible plans with HSA.

A: Yes. Must meet federal standards.

A: Medicaid, CHIP, subsidized marketplace plans.

A: Reduce long-term medical costs and avoid expensive treatments.

Final Thoughts

Choosing the right family health insurance in 2026 protects your family and finances. Compare providers, costs by state, and coverage carefully. Start planning today to secure peace of mind and financial safety.

For more expert guides, see:

Ahmada Ndao est entrepreneur digital et consultant en intelligence artificielle, fondateur de SenAI2S.

À travers Nexuora, il partage des analyses, guides pratiques et stratégies sur l’IA, le business en ligne et les technologies émergentes, avec un focus sur l’impact réel et les opportunités globales.